Worried about inflation? We’ll take a look at what’s happening, what to expect for the future, how we got here, and what you can do to weather the storm.

With the measures that the government took in response to COVID-19, prices are about to go up for EVERYTHING. The stimulus payouts made by both presidents Trump and Biden with congressional approval means inflation is well on its way. As a matter of fact, inflation is already happening.

But this has been snowballing for many years, long before anyone ever heard of COVID-19.

Early Signs

Bank of America recently put out a press release alerting the public that inflation is already here. In the last year alone, the Federal Reserve injected over 25% of all newly made dollars.

Because lockdown restrictions closed millions of businesses—which rendered many people jobless— goods and services are grinding to a halt.

Government Failure

For example, Janet Yellen, current Treasury Secretary, announced how the policies of COVID-19 put 22 million women out of work and more than two million have yet to return. She also mentioned how these numbers are even worse for men. This is because, according to Yellen, their policies failed to account for how people’s lives link to their work lives.

Plus, some states that supply most of the country’s meat, like Nebraska and Texas, either forced shutdowns of their processing plants or ordered the slaughter of viable livestock and cattle. This was somehow done as a safety measure.

A Grim Future

Although not taking hold yet, you can see the beginnings of shortages with food, energy, and gasoline. Certainly, you have seen this already at grocery stores and gas pumps.

The money included in the stimulus bills given to countries, projects, and corporations, that have nothing to do with maintaining health and the economy, are going to contribute to this inflation earthquake as well.

Tax Hikes

And, unfortunately, Biden’s tax increases for individuals and businesses making over $400,000 per year, will be detrimental. It doesn’t matter that those who make less won’t pay as much in taxes. This is because businesses themselves will not pay this; they will pass it onto the consumer.

A Historical Overview

To paraphrase founding father, Thomas Jefferson, if Americans allow private banks to control the printing and distribution of money, complete with deflation and inflation, it will deprive people of all property and into homelessness. This is because Jefferson understood how banks can be more dangerous than standing armies.

What’s interesting about Jefferson’s statement is that it came long before the creation of the Federal Reserve in 1913. Two days before Christmas in 1912, Congress voted to unconstitutionally give money-printing power through the Federal Reserve Act.

It’s a Private Bank

The name “Federal Reserve” is a misnomer, it’s a private bank owned by anonymous stockholders. Since its inception, we’ve seen individual tax mandates, two world wars, and several domestic economic strains. The Federal Reserve has admitted to creating such problems.

To illustrate, Ben Bernanke was part of the Federal Reserve’s Board of Governors in 2002. At this time he testified in a congressional session how the Federal Reserve was responsible for the Stock Market Crash of 1929.

We haven’t seen a significant amount of inflation since the 70s. Instead of the Federal Reserve allowing us to plummet a little, like in 2008 and 2011, Janet Yellen, Chairman of the Federal Reserve at the time, engaged in something called “quantitative easing.”

Quantitative Easing

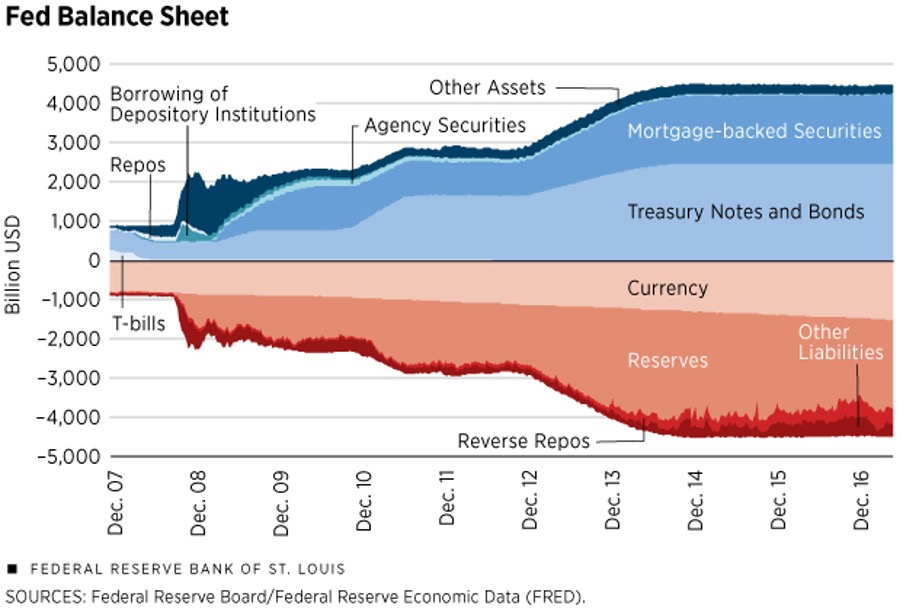

Quantitative easing helps inject money into the market—read up on this here: https://www.reuters.com/business/fed-announce-qe-taper-aug-or-sept-rising-inflation-concerns-2021-06-11/

It is a monetary policy that allows for the large-scale purchase of things like assets and government bonds from commercial banks and other financial institutions.

This then raises the prices of those assets while, at the same time, lowering their yield. This, in turn, helps to increase the money supply. And although this has kept the economy afloat, it’s also setting Americans up for a world of hardship.

The Go-To Solution

Although this kind of tool can be useful when applied sparingly, this has been the go-to solution by the Federal Reserve for over a decade. Had they allowed the market to play out, the pain would be much less severe.

Protecting Yourself

Try expanding your portfolio with precious metals and cryptocurrencies. For the moment, gold and silver are reasonably inexpensive. You won’t be able to use these to pay for things, but they will protect your home, savings, and other assets.

In regards to cryptocurrencies, there are things like Bitcoin and Etherium. But, if you don’t have extra money, a few platforms reward crypto for using their sites like Brave Browser, Odysee, and Minds.

Understand the storm has already begun; it’s the oncoming earthquake you have to brace for. While there’s some time, sit down and be realistic about your finances. Invest in what you can, build a garden, and come up with a plan B. This is the best way to keep your sanity while maintaining necessities.