With growing concerns of the future of brexit and the UK economy as a whole, international money transfer popularity is at peak. Whether it’s large corporations, small businesses, or simply individuals – everyone is interested in defending against the Sterling’s potential collapse. Additionally, there are many businesses and individuals (expats mainly) who simply require to conduct cross border bank transfers on a constant basis.

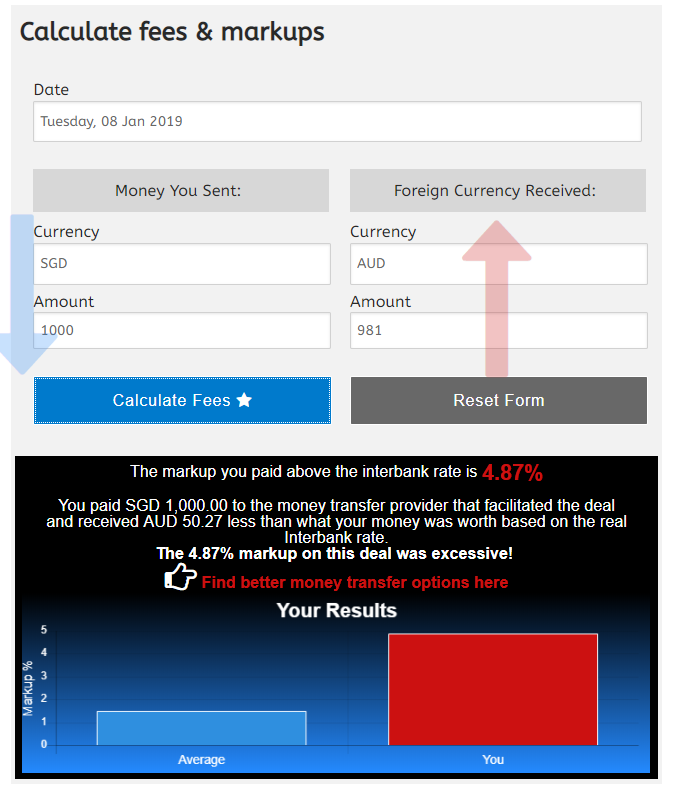

The problem with high-volume foreign exchange transfers is one – the exchange rate applied on a transfer can be horrendous. What it actually means is that for every Euro or dollar you exchange, you get fewer pounds. How much fewer? The exchange rate on the common currencies like USD, AUD or EURO may get as high as 2.5% or 3%, while exotic currencies can be upward of 4% margin. For the individual or business who is moving substantial amounts of money abroad this could devastating. Review site moneytransfercomparison.com has released a fee calculator that can help clients understand exactly how much they paid for a past deal, or how much they are intending to pay with a current quote provided to them by their bank or a specialist provider.

The calculator uses a set of rules to not only show what margin the client will be paying (or has already paid), but also provide an indication whether the margin taken is “within reason”. Private clients and small businesses should never expect to trade currencies as the actual spot rate because that rate is named the “interbank rate” for a reason – it is the rates that banks will use to transfer money among themselves (and at times, with central banks). With that being said, international money transfers is a pretty competitive market with many participants. There are more than 100 FCA-approved currency exchange providers in the UK who are happy to take clients from banks by offering them better exchange rates. The money transfer fee calculator uses proprietary industry knowledge on the expected margin that such providers will offer, taking the corridor and amount into account, and thus is able to indicate what’s a “too much” when it comes to cross border transfer fees.