Most of us have taken loans from a lending institution, family and friends. After all, money is a limited commodity, and we often struggle with the persistent shortage of money- this is where the need to borrow a loan comes in.

According to Lånasmart.com, there are different lending institutions for diverse clients. If you are short on cash and you want to buy your favourite pair of shoes, pay bills, or invest 100k in a start-up; there are lending institutions that are willing to give you a loan.

Economists agree that loans are very important for the economy. Individuals, businesses, and even the government rely on loans to meet their budget deficit. Borrowing is what keeps banks in business.

Let’s explore the reasons as to why loans are important to the economy.

Loans are a source of capital investments.

Investment is the main driver for economic growth across Europe. Small, medium and large-scale investors rely on loans for their capital expenditures that stimulate business activities and the growth of the economy.

Business owners rely on bank loans from banks, investment partners and other lending institutions such as the European Investment Fund (EIF) to access much-needed financing to stimulate business growth. The loans are injected into businesses to generate income for the business owner, and interests for the lending institutions.

Impact of Loans on European Banks

Banks are immensely affected by credit growth in an economy. The core business for banks and other lending institutions is to give out loans in return for interest. Banks are the main beneficiaries of the increasing number of loans and this leads to increased revenue.

Statistics show that the consumption of loans in the European market has been growing steadily. Alternative lending has grown immensely with the total transaction value in the segment amounting to US$9,665.2m in 2020.

Sustains economic cycle

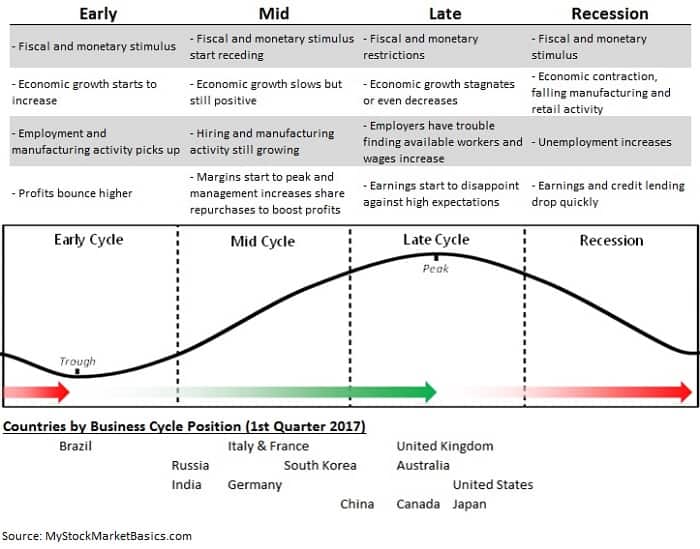

The economic cycle has four phases: early, mid, late, and recession. The cycle is repetitive in nature, though the lengths of the cycle vary.

The economic cycle begins through a debt cycle when business owners take loans to expand their businesses. When the cycle keeps expanding, businesses grow and the GDP expands. The positive growth comes with other benefits such as an improved standard of living and declining unemployment.

4. Loans and Economic Stability

Governments use loans, through the Central Bank, to maintain economic stability. This is demonstrated through the following scenarios:

During Inflation

- Inflation occurs when there is an increase in the cost of goods and services. This reduces the ability of consumers to purchase products and services.

- Inflation occurs because there is a lot of money in circulation and not enough goods/services.

- Inflation occurs when there is an increase in loans and other sources of money into the economy driving the prices of commodities up.

The government controls this situation through high-interest rates. High-interest rates imply that many individuals cannot afford to borrow loans favoring saving rather than spending. Consequently, reducing the inflation rate.

During Deflation

Deflation is the exact opposite of inflation. It occurs when consumers are suffering from reduced purchasing power. Deflation affects the economy and businesses negatively as the prices of goods and services will remarkably drop.

The government corrects this situation through loans. The central bank reduces loan interest and other conditions for taking a bank loan to stimulate borrowing. This will increase the money in circulation and control deflation.

The Bottom Line

Loans form the foundation of a successful economy.

The availability of loans implies that one can take a loan for consumption or investment purposes. A single loan can benefit different players in the economy apart from the borrower and the lender. There are many forms of loans, including mobile and online loans, which has made it easy to access loans. Why not take advantage of these loans to improve your business.