European Youth Most Affected...

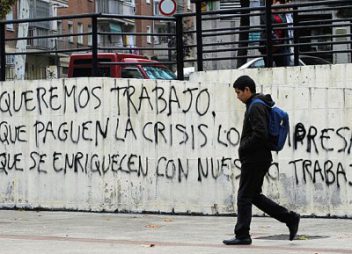

Growing unemployment in Southern European countries is hurting young people the most, new data from the OECD unemployment survey shows. The latest OECD survey paints a bleak picture of economic opport...

Greece Close to Reaching Bai...

Greece will soon receive another bailout from international lenders, the country’s leaders claim. The Greek government is in talks with lenders from other Eurozone countries over whether the struggl...

Athens Airport’s Ghost Air...

Greece’s struggle to reduce its public sector spending has been a political hot point for several years. The struggling nation, which is one of several Southern European countries to experience slug...

More signs indicating collap...

When a global leader in the insurance industry is openly admitting that they have reduced their exposure to the crisis in the eurozone and have prepared for its demise, the world should stand up and t...