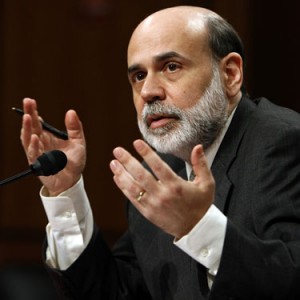

The Federal Reserve has started two days of meetings to discuss plans to reduce its stimulus spending. Analysts believe that the meetings will end with Federal Reserve chairman Ben Bernanke announcing cutbacks to its economic stimulus programme.

The Federal Reserve has started two days of meetings to discuss plans to reduce its stimulus spending. Analysts believe that the meetings will end with Federal Reserve chairman Ben Bernanke announcing cutbacks to its economic stimulus programme.

Economic stimulus measures started by the Federal Reserve have attracted a great deal of both praise and scorn from economists. Many have praised the measures for keeping the United States economy afloat during the difficult post-crisis period.

Others believe that the Federal Reserve’s policy of buying government bonds and other financial instruments has increased inflation and reduced buying power for millions of Americans, while pushing opportunities to exporters based overseas.

The Fed is currently spending over $85 billion per month in order to stimulate the economy. The current stimulus programme includes buying large quantities of US government bonds, with current purchases totalling over $800 billion.

In June, Mr Bernanke announced that the Federal Reserve would reduce the scope of its bond-buying programme if the United States economy continued to show signs of long-term improvement.

Recent improvements to the labour market and increases in consumer spending all point towards a decline in stimulus programmes. Because of this, analysts believe that Mr Bernanke will announce major tapering measures after the meetings.

Bernanke’s leadership of the Federal Reserve has been controversial, and the Fed chairman has been vocal about his lack of interest in seeking a third term. Barack Obama is currently looking for a replacement for Bernanke, who will soon resign.

Analysts have pointed towards the declining US unemployment rate – which was just 7.3 per cent last month, down from 8.1 per cent one year ago – as an obvious indicator of the success of the United States economy.

Other analysts have pointed to the growing scale of the Quantitative Easing funds and noted that the economy should be left to recover without large amounts of government spending continuing through the Federal Reserve.