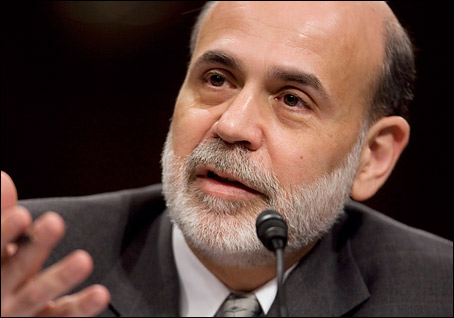

Recent announcements by Federal Reserve chairman Ben Bernanke about the end of quantitative easing have caused ripples in many markets. The Fed’s QE3 policies, which involved expansion of the United States’ money supply and large-scale asset purchases, will come to an end during 2014 due to sustained economic growth.

Recent announcements by Federal Reserve chairman Ben Bernanke about the end of quantitative easing have caused ripples in many markets. The Fed’s QE3 policies, which involved expansion of the United States’ money supply and large-scale asset purchases, will come to an end during 2014 due to sustained economic growth.

After announcing that the QE3 program will come to an end during 2014, several key financial markets saw a decline in purchasing and a ‘sell off’ involving a wide range of investors. Many investors heavily involved in gold markets sold off their holdings, causing a major decline in the value of popular gold futures.

Gold pricing stabilised at around $1,300 per ounce – a price that hasn’t been seen since mid-2010. Other declines in value were seen by several currencies that trade heavily with the United States dollar, such as the Australian dollar and Indian rupee.

Australia’s currency, once worth more than the United States dollar, dropped to a value of just $0.92 USD in recent trading. The Indian rupee, which was previously trading at 58.7 to the dollar, dropped to 60 to the US dollar over fears that ending Fed policies could result in a decline in exports to the United States.

Given that the Fed announcement was prompted by strong growth in the United States, the sudden drop in markets has been seen as something of a warning sign, particularly for bearish US-based investors. Many believe that an end to QE3 will send the US back into recession, while others are more bullish on growth.

While several currencies rebounded in trading after the announcement, the sudden ‘sell off’ has many worried that the end of large-scale quantitative easing could be a major financial disruption for US-based commodities, stock, and currency investors.